- Ark Invest's flagship Disruptive Innovation ETF has fallen 32% from its record high in February.

- Detailed below are the five stocks that helped drive the decline in the tech-focused ETF managed by Cathie Wood.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

The reflation trade out of growth and into cyclicals in anticipation of a reopened economy has damaged the flagship ETF managed by Cathie Wood's Ark Invest.

The ARK Disruptive Innovation ETF has declined 32% since its peak at $160 in mid-February. The ETF is down 13% year-to-date, a flip from its 2020 return of nearly 150%.

Despite the negative returns for the ETF in 2021, investors are not backing down from investing alongside Wood, as $6.7 billion has flowed into the ETF year-to-date, according to fund flow data from ETF.com. The ARK ETF still has more than $21 billion in assets under management.

Detailed below are the five stocks that helped drive the decline in the tech-focused ETF managed by Cathie Wood, based on Thursday afternoon prices.

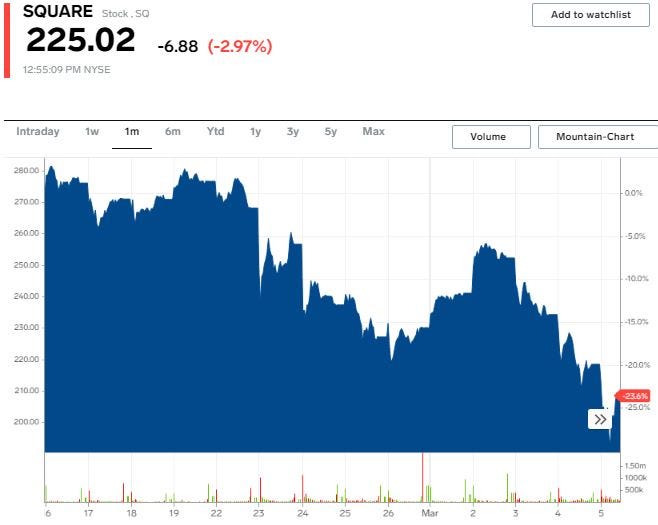

5. Square

Ticker: SQ

Decline from peak: 20%

% of ARKK ETF: 4.66%

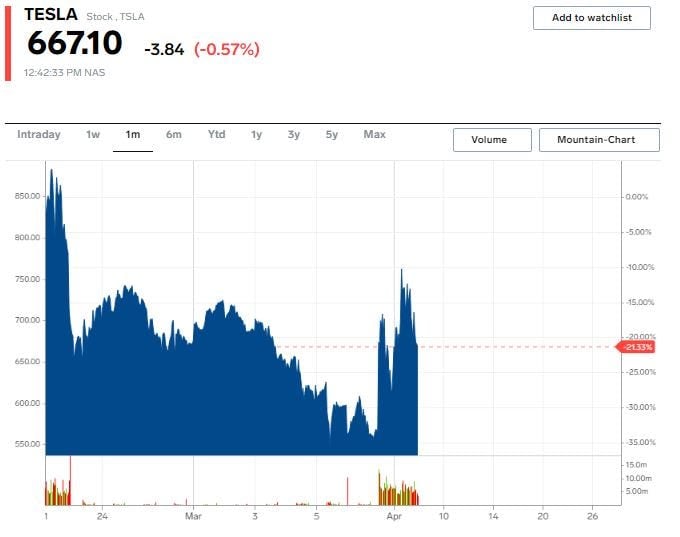

4. Tesla

Ticker: TSLA

Decline from peak: 26%

% of ARKK ETF: 10.77%

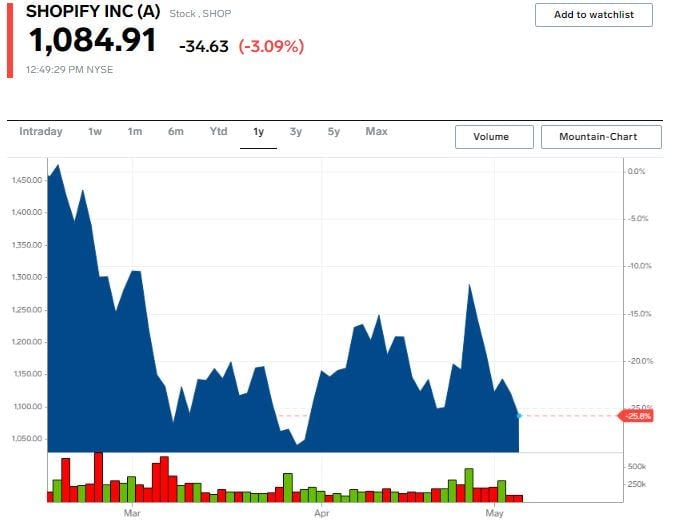

3. Shopify

Ticker: SHOP

Decline from peak: 28%

% of ARKK ETF: 3.66%

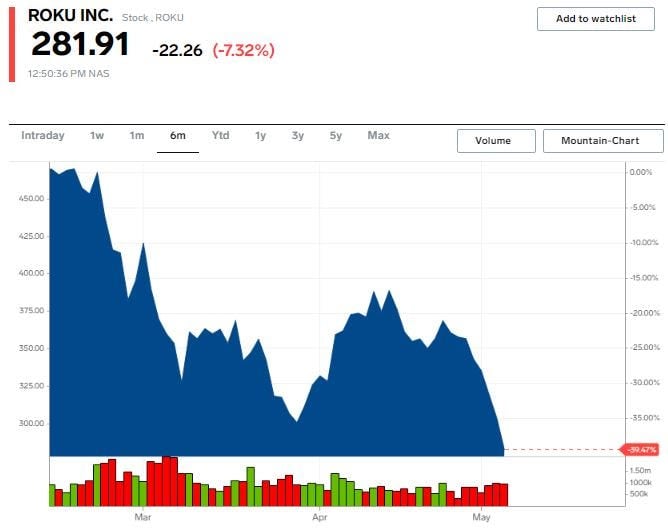

2. Roku:

Ticker:ROKU

Decline from peak: 42%

% of ARKK ETF: 4.79%

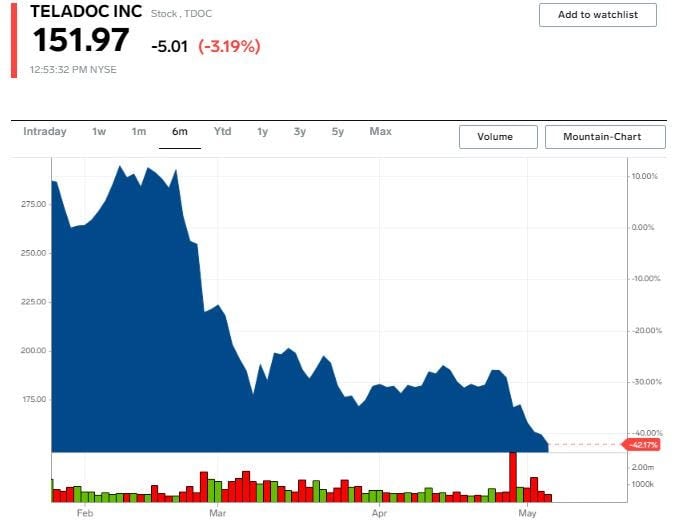

1. Teladoc

Ticker: TDOC

Decline from peak: 50%

% of ARKK ETF: 6.37%